Article Archives by Subject: Economics

|

Permalink

The Hammock |

Subject: Wealth Redistribution, By Any Other Name, Is Still

Slavery

Recently, Florida's Republican Representative, Allen West, gave a

speech in Congress

where he stated:

|

|

Permalink

I'm Entitled To It! |

Subject: TANSTAAFL

"There ain't no such thing as a free lunch."

— Robert Heinlein, The Moon is a Harsh Mistress

When Heinlein wrote these words, he was simply referring to the obvious fact that you cannot get something for nothing. Everything consumed must first be produced and everything bought must be paid for. For previous generations, this was a common-sense observation with which all reasonable people agreed. However, these days, that is far from the case, and whether the adage is applicable or not depends upon just exactly what type of person you happen to be. Back in December, I wrote an article titled, Money for Nothin' and Your Chicks For Free, where I briefly examined the history of the ever expanding welfare state and the subsequent erosion of the American work ethic, all of which ultimately led to the creation of a population substantially trapped in the morass of a new found learned helplessness. And what are the practical consequences of this? For that, I refer you to the following story, released earlier today:

Update:

External links to reprints of this article: |

|

Permalink

mint.com |

Subject: Celebrating American Wealth

On the financial management website,

mint.com, there is an article

titled, The

Wealthiest Americans of All Time, which looks at the richest

Americans since the founding of the country, converting their net

worth at the times of their death (if applicable) into 2010 dollars.

The information is then presented in the interactive chart displayed

below. You can roll your mouse over the various bars to see the 25

richest Americans of all time. When comparing apples-to-apples in

this way, it is interesting to see that

Bill Gates

($53 billion) and

Warren Buffet

($47 billion) currently rank at #13 and #16 respectively —

quite far below

John D.

Rockefeller who amassed a 2010 net worth of $192 billion.

But what really impressed me about this chart was the comment which

reads:

|

|

Permalink

Beer and Taxes |

Subject: The U.S. Tax System Explained With Beer

This little story† has been

floating around the internet for quite some time, and the author is

unknown to me. It makes a very important point quite forcefully!

Suppose that every day, ten men go out for beer and the bill for all ten comes to $100. If they paid their bill the way we pay our taxes, it would go something like this:

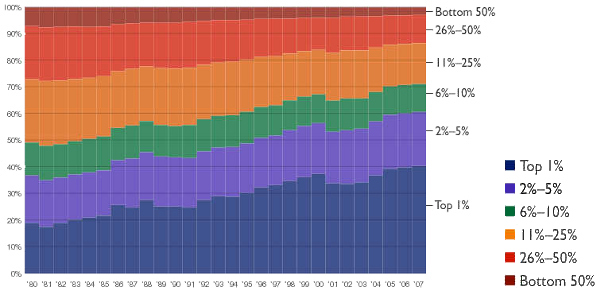

For those who do not understand, no explanation is possible." † I reworked the numbers in the story slightly because they did not properly add up in the versions that I saw. It doesn't make a very convincing economics example if you can't add properly! ‡ "Seemed" is the operative word here. Just because a taxpayer doesn't spend every waking moment of their life complaining bitterly, do not assume that that means that they are "quite happy" with the system and how they are being treated! Addendum: [01-05-10] I thought it would be instructive to show the actual percentage of taxes paid by various income groups. The following chart comes from The Heritage Foundation and is for the year 2007, showing the percentage of taxes paid by different segments of the wage-earning populace.

|

|

Permalink

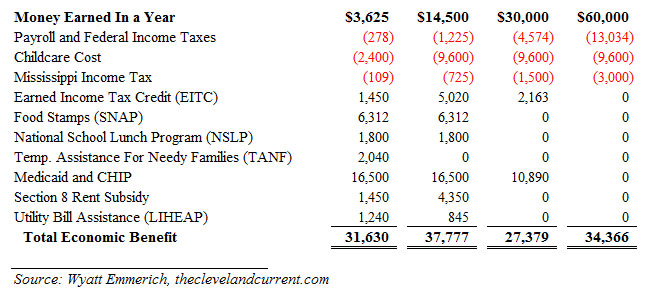

Wyatt Emmerich |

Subject: Working Is For Suckers

This is a follow up to my previous article Money For

Nothin' and Your Chicks For Free, where, among other

things, I discussed the erosion of the American work ethic as a

consequence of government welfare programs.

Wyatt Emmerich, the editor of the Weekly Mississippi publications, the

Northside Sun and

The Cleveland

Current, recently published an interesting article titled,

With

welfare it makes sense to work less, in which he wondered why

new manufacturing plants were no longer opening in his state. Here

is what he learned:

The second column shows the taxes taken and welfare benefits received

by someone earning minimum wage ($14,500/year), while the forth column

shows the taxes/benefits for a family working a job which earns

$60,000/year. The minimum wage earner actually ends up with $3,411

in additional disposable income!

Even more shocking is the first column, which shows what happens if

one were to work the minimum wage job only one week each month rather

than full time. While the earned income would be cut by 75%, taxes

would fall by $8,763 while benefits would increase by $4,035, for a

net gain of $12,798. This means that working only 25% of the time

at a minimum wage job, will yield 92% of the disposable income

available to the full time worker earning $60,000, leaving three

weeks each month to either lounge around, or possibly work an illegal

black-market job that would put you far ahead of the full-time

worker.

What's the message: Only chumps work for a living.

This relatively simple example demonstrates everything that is wrong

with the U.S. economy. Each time the government interferes with

natural market forces, they incentivize parasitic behavior while

penalizing productivity, further impeding the economic engine. There

is only one solution: eliminate all of these government programs and

return to a system of private charity and investment to aid those truly

in need. No one who was responsible for spending their own funds would

ever consider freely participating in a system as corrupt as this. It

is only when an impersonal government is allowed to become a third

party in wealth redistribution, that results of this type becomes

possible. The time has come to just say no to public

welfare of every type. If you agree, let your voice be heard.

The second column shows the taxes taken and welfare benefits received

by someone earning minimum wage ($14,500/year), while the forth column

shows the taxes/benefits for a family working a job which earns

$60,000/year. The minimum wage earner actually ends up with $3,411

in additional disposable income!

Even more shocking is the first column, which shows what happens if

one were to work the minimum wage job only one week each month rather

than full time. While the earned income would be cut by 75%, taxes

would fall by $8,763 while benefits would increase by $4,035, for a

net gain of $12,798. This means that working only 25% of the time

at a minimum wage job, will yield 92% of the disposable income

available to the full time worker earning $60,000, leaving three

weeks each month to either lounge around, or possibly work an illegal

black-market job that would put you far ahead of the full-time

worker.

What's the message: Only chumps work for a living.

This relatively simple example demonstrates everything that is wrong

with the U.S. economy. Each time the government interferes with

natural market forces, they incentivize parasitic behavior while

penalizing productivity, further impeding the economic engine. There

is only one solution: eliminate all of these government programs and

return to a system of private charity and investment to aid those truly

in need. No one who was responsible for spending their own funds would

ever consider freely participating in a system as corrupt as this. It

is only when an impersonal government is allowed to become a third

party in wealth redistribution, that results of this type becomes

possible. The time has come to just say no to public

welfare of every type. If you agree, let your voice be heard.

Addendum: (From the newsgroup rec.humor.funny)

|

|

Permalink

Coming Home To Roost |

Subject: Money For Nothin' and Your Chicks For Free

"For many, immaturity is an ideal, not a defect."

— Mason Cooley

Since the founding of this country, each generation has faced its own unique set of difficulties and struggles, whether those happened to be droughts, floods, fires, tornados, earthquakes, hurricanes, wars, abolition, suffrage, civil rights, economic depression, or any number of other natural or man-made challenges. The economic, social and environmental problems that confront us today have their own unique character, but are actually no worse than many of those of the past. However, there is a fundamental change that has occurred in our society that does not bode well for our future. Where once the majority of people understood that they must face their problems with the will and strength of character to perform the work necessary to overcome obstacles, this is no longer the case. Today, we now find ourselves in a society where a sizable segment of the populace has been trained to abdicate this responsibility and simply rely upon government management and its financial assistance to mitigate any hardships needing to be faces. Effectively, we now have a class of perpetually dependent, aging adolescents who have never been required to "grow up" and assume the mantle of responsible adulthood. How did we arrive at this state? The Erosion of the American Work Ethic: America was colonized by people who understood the value of hard work and perseverance. Traveling across the Atlantic with few possessions, effectively cut off from European aid or assistance, the early settlers knew that their survival depended upon their ability to address whatever circumstances presented themselves. So important were these characteristics, that they became codified as religious virtues, handed down from generation to generation in what sociologist Max Weber would later come to classify as the Protestant work ethic. The great accomplishments and economic growth achieved throughout the history of this country are the result of this spirit of productiveness and personal drive exhibited by so many people in pursuit of their dream of creating a better life for themselves. Another principle shaping the founding character of this country was the virtue of independence or self-reliance, best seen embodied in the concept of individual rights as delineated in the Declaration of Independence. The recognition that each person was master of their own life, with the unfettered liberty to guide themselves in a manner of their own choosing, implied an acceptance of the responsibility for dealing with their personal survival and happiness. In this country, the future was in one's own control, to be principally determined by the consequences of one's actions. From the 17th through the early 20th centuries, the causal relationship between the application of effort, perseverance and self-reliance could be clearly seen resulting in a steadily increasing prosperity, which conveyed an extremely important lesson to each subsequent generation. In general, the American culture was acknowledged as having an optimistic view of the future with a "can-do" spirit, where, with hard work, anything was possible. Opportunities were limitless, while resignation and defeat were not treated as viable options. Still, there were counter-forces at work destined to undermine this positive American psyche. Of course, there was the ever-present call for self-sacrifice which has permeated every society on earth. The philosophy of altruism was the antithesis to the value-based culture of the United States. Whereas individualism preached productiveness and pride in one's achievements, altruism demanded the relinquishing of all that was valuable, and a sense of shame in one's abilities. While the goal of individualism was personal happiness, the end result of altruism was the embrace of pain and suffering as noble. In practice, Americans rejected the worst aspects of altruism, but at the same time, lacking a proper philosophical defense against its teachings, accepted the psychological burden of guilt for having repeatedly failed to live up (actually down) to its anti-life requirements. However, the greater damage to American culture began in earnest with the inception of the welfare system. The existential roots of welfare in the United States extend back to 1642 with the creation of the first compulsory public school in the Massachusetts Bay Colony. Here, the acquisition of an education was declared to no longer be the responsibility or each individual, but a "right". And at the same time, it was also dictated that these individuals no longer retained their free choice in deciding if, when, and by what means, they would pursue that education. Instead, authorities would compel them to attend school at the prescribed place and time, for the mandated duration, studying predetermined subjects and material. In addition, other working member of society would then be forced to bear the cost for providing this newly created "right". And so it began. Whenever a so called "positive right" to a good or service is introduced, it carries with it two direct consequences: the undermining of one or more inherent natural rights (in this case, life and liberty), and the forced enslavement of those who are required to provide the good or service to others. Furthermore, the creation of two opposing groups — the providers and the consumers — leads to indirect psychological consequences: resentment on the part of providers, and a demanding expectation on the part of the consumers for what they have been told is their entitlement. The imposition of the modern welfare state began in earnest with Franklin Roosevelt during the Great Depression of the 1930s, was dramatically expanded by Lyndon Johnson in the 1960s, and has been continually growing ever since. And assistance is no longer limited to individuals in need, but now encompass groups, businesses and entire industries. We are all familiar with the ubiquitous Public Education, Social Security, Medicare and Medicaid benefits, but that only scratches the surface of the many assistance programs that our legislators have created over time. A quick review of a few news articles revealed the following currently active programs:

Direct Loan Direct Payments for a Specified Use Direct Payments with Unrestricted Use Dissemination of Technical Information Federal Employment Formula Grants Guaranteed/Insured Loans Guaranteed/Insured Loans Insurance Investigation of Complaints Project Grants Provision of Specialized Services Sale, Exchange or Donation of Property or Goods Training Use of Property, Facilities or Equipment

External links to reprints of this article: |

|

Permalink

"The Bernank" |

Subject: Inflation is Not Your Friend!

Federal Reserve chairman Ben Bernanke thinks that we don't have enough

inflation in this country, so he is now engaged in printing up $600

billion crisp new dollars with which he will purchase government

securities such as treasury bills. Of course, the average person has

a glimmer of understanding that just printing money out of thin air

might not be such a good thing to do. (Don't we call that

counterfitting when others do it?) So the Fed tries to distract us

from those concerns by calling it Quantitative Easing, because

who actually understands exactly what that means? Well, let's

allow this short video explain it to us.

|

|

Permalink

Nancy Pelosi |

Subject: How to Solve the Housing Crisis - Government Style

Well, take a look at this article in the Spokesman Review titled,

Health law's heavy impact"

for a review of some of the taxes you will soon be experiencing as a

result of that legislation. Of particular note is the new 3.8% tax

on real estate transactions. This means that if you buy/sell a

$300,000 home, you will pay a tax of $11,400, and if the home goes

for $750,000, the tax will be $28,500. And remember, this is on

top of all the current real estate taxes that are already being

imposed. If you are young and mobile in your career, this is a tax

that will hit you every time you relocate.

Or maybe you are older and were thinking of retiring to a new

location. Open up your wallet, because all real estate throughout

the country will immediately increase in cost by about 4%. Or

possibly you are in business and are thinking about expanding your

growing practice by moving into a new facility that will cost

$30 million. You new tax would then be a whopping $1,140,000.

Yes, that ought to make you think twice about that move.

Given our current housing crisis, with an oversupply of homes that

is killing the entire construction industry, can you think of a

worse idea for addressing these problems than to increase the cost

of all homes by a huge amount, pricing more people out of the housing

market and further reducing demand. As Cloud Downey also noted, the

immediate impact will be to further flood the market with home sales,

as owners attempt to sell before the tax kicks in. And reviewing the

overall state of the economy, with so many businesses struggling to

stay afloat, consider how damaging a new tax of this magnitude will

be, making capital investment that much more difficult and retarding

any latent recovery.

Is there still a person out there who can state with a straight face,

that when it comes to managing the economy and the lives of each

of us, that the government is qualified to make intelligent choices

that are in the best interest of the citizens? If there is such a

person, then my response is the same one Joe Wilson gave to Obama:

"You lie!"

[Thanks to Cloud Downey for bringing this article to my attention.] |

|

Permalink

Hyperinflation |

Subject: Preparing Americans for Hyperinflation

Here is a thought-provoking video that discusses the causes of

past hyperinflation in countries around the world and why the

current monetary policies in the United States are guaranteeing

that we are headed towards the same result.

|

|

Permalink

Bloomberg |

Subject: So, Was Joe Wilson Wrong When He Called Obama a Liar?

In an article by Jonathan Weil titled,

Obama's $6.3 Trillion Scam Is America's Shame,

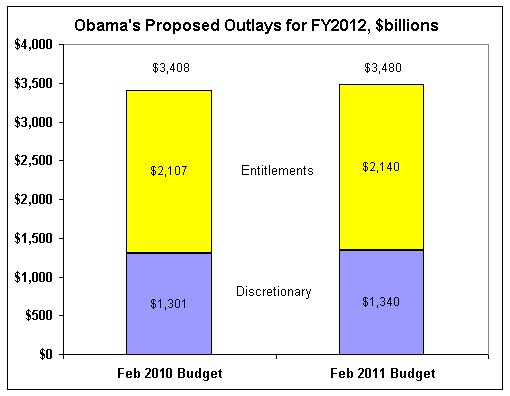

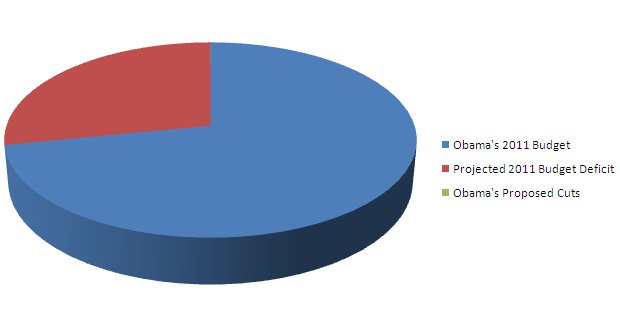

he reports that the President's latest $3.8+ trillion federal budget

leaves out a few minor items that might have a little bit of impact

upon the country. For example, this budget does not include:

[Thanks to Mark Kalinowski for bringing this article to my attention and to Pamela Geller for breaking the story.] |

|

Permalink

Federal Jobs |

Subject: Solving the Unemployment Problem — One Federal Job at a Time In his State of the Union address, Barack Obama stated that he was going to focus on solving America's unemployment problem. A few days later he released details for his $3.8 trillion 2011 budget, indicating his intention to continue with his, so far, spectacularly failing plan to spend his way out of our economic woes. Today in the Wall Street Journal (WSJ), there is a report entitled Uncle Sam Wants You, which highlights just exactly how and where all of this "economic stimulus" is actually paying off. And the answer is: in the ranks of federal employees. As the WSJ reports, "civilian full-time equivalent employees" within the government's ranks has increased 14.5% in just the past two years, bringing 20 2.148 million, the number of federal employees in 2010. Unlike workers in private industry, federal employees neither produce nor contribute to the production of tangible goods and services that form the basis of our economy. Where as a worker in the private sector acts to generate wealth which pays for their own employment, government is simply a net consumers of wealth, and every new federal employee place an additional burden on the remainder of the economy to carry them. So, as usual, Obama is merely shuffling papers, moving names from the list of the "unemployed" to a new list of "federal workers". But the net effect is zero, because the funds for the salary of a government worker must be extracted from the surplus economic efforts of productive private-sector employees, just as the funds for an individual who receives an unemployment check must first be produced by others. It is all a game of smoke and mirrors, with no actual economic gain. But there is a terrible economic cost to all of this. For the billions and trillions of dollars that the government removes from the economy, directly through taxes, or indirectly through inflation, are funds no longer available for capital investment by businesses actually engaging in processes of true wealth creation. This retards the recovery and expansion of the economy, which means new productive jobs are not created, which means that real unemployment remains high. |

|

Permalink

China |

Subject: Too Good To Pass Up .... OK, this doesn't have anything to do national service, but it was just too good to let slip by unnoticed. Do you have any idea where your tax dollars go? Well here is where $2.6 million of them went! Maybe if we keep their prostitutes happy, the Chinese government won't try to cash in the roughly one trillion dollars of U.S. Treasury Bonds (over 10% of the total US debt) that it is currently holding! [Thanks to Fred Bartlett for the reference.] |

|

Permalink |

Subject: Recommending A Couple of Good Articles

Although not related to the topic of mandatory service, I would like

to recommend the following articles. This is from the Wall street

Journal, and is titled,

Clunkers in Practice.

This short piece asks and answers the question of just how effective

the government's "Cash for Clunkers" stimulus program was. At a total

cost of roughly $3 billion, studies have shown that once the program

stopped, GM and Chrysler car sales fell 42-45% below the abysmal

sales figures from one year ago. On the environmental front, the

the total program resulted in reducing oil consumption by only 0.2%,

and that the country as a whole is now $1.4 billion poorer. Is that

change you can believe in?

On a more related subject, the second article, by Gen LaGreca, was published in the OC Register and is titled Orange Grove: Which end of the leash do we prefer? The author explains why, unlike dogs, people do not appreciate being lead around on a leash. It may seem obvious, but people commenting on the article who are obviously missing the point, seem to have less brains than most dogs. [Thanks to Cynthia Gillis for bring the second article to my attention.] |

|

Permalink |

Subject: Running the Numbers: Over One Billion Served Let's do a little math. According to the US Census, in 2007 there were 55 million students enrolled in grades K-12, and 17.6 million college students. Assuming a roughly equal age distribution of students, then there would be 4/13 * 55 million, or about 16.9 million high school students. So 16.9 + 17.6 = 34.5 million high school/college students. From my research, it looks like the annual requirement for mandatory community service in these schools ranges between 20 and 40 hours, so let's assume an average of 30 hours/year. Multiplying this by the available student population yields: 30 * 34.5 million = 1,035,000,000 hours. Yes, that is correct: OVER ONE BILLION HOURS! For 2009, the federal government has set the minimum wage at $7.25/hour. Therefore, the dollar value for the mandatory work being forced from students at the high school and college level each year is potentially worth over $7.25 billion dollars. Year after year after year. Do we need to look any further to understand the real motivation behind this push for mandatory national service? This is nothing more than slave labor being extracted from the nation's children. And it is being done under an indoctrination program designed to make every one of those children believe that they owe their labor to — the state, the community, the school or whatever collective group you care to substitute — but they owe it as a duty — and the group has a right to collect it from them upon demand. Contrary to what the Constitution states, their lives are not theirs, to do with as they choose, but something to be sacrificed in service to a higher cause. So why stop with low-priced school kids. Just think of the value to be had by turning every citizen into a national slave? Let's see, there are 300,000,000 of us, at an average salary of ....... Well, you get the idea. This movement must be stopped! By the way, it took McDonald's around 15 years (1948-1963) of constantly expanding nationwide service in order to serve one billion hamburger patties. That's a lot of hard work to get to a number like that. And every one of their employees, and every one of their customers interacted with McDonald's on a truly voluntary basis. |

|

Permalink |

Subject: Peter Schiff: Running for Connecticut Senator in 2010 Peter Schiff is an economist and broker who predicted, with astounding accuracy, the economic and housing crisis, while most others, in the both the financial industry and the government, derided him as simply loony. Here is a link to a video of a Mortgage Bankers Speech that Peter gave back on November 13, 2006, in which he outlines, in detail, exactly what was—and still is—wrong with the American economy. He then states, without equivocation, what the natural, and therefore predictable, consequences of those policies must be. It is an extraordinary eye-opener! This is such an important piece that I believe it should be seen by anyone interested in our current state of affairs. Therefore, I have added the link here in order to give it additional exposure. The video is roughly seventy-three minutes long, but it is an education in important economic concepts and well worth the time invested. If you agree, pass along to others, a link either to the video, or back to this site. Peter Schiff is currently running in 2010 for the Connecticut Senate seat currently held by Christopher Dodd. If you find the Schiff video interesting, I would also recommend an eighty-six minute video of a talk by John Allison, the CEO of BB&T Bank, given back on January 29, 2009, titled The Financial Crisis: Causes and Possible Cures. [Thanks to Cloud Downey for bringing the Schiff video to my attention.] |

|

Permalink |

Subject: Community Service Is Not What Made America Great

I discovered an excellent article by C. Edmund Wright at American

Thinker, entitled "Community Service Is Not What Made America

Great, which I would encourage everyone to read. Here

are a few excerpts:

|