04-26-2011

Permalink

I'm Entitled To It!

|

Subject: TANSTAAFL

"There ain't no such thing as a free lunch."

— Robert Heinlein, The Moon is a Harsh Mistress

When Heinlein wrote these words, he was simply referring to the obvious

fact that you cannot get something for nothing. Everything consumed

must first be produced and everything bought must be paid for. For

previous generations, this was a common-sense observation with which

all reasonable people agreed. However, these days, that is far from

the case, and whether the adage is applicable or not depends upon just

exactly what type of person you happen to be.

Back in December, I wrote an article titled,

Money

for Nothin' and Your Chicks For Free, where I briefly examined

the history of the ever expanding welfare state and the subsequent

erosion of the American work ethic, all of which ultimately led to the

creation of a population substantially trapped in the morass of a new

found learned

helplessness. And what are the practical consequences of this?

For that, I refer you to the following story, released earlier today:

|

Tuesday, April 26, 2011

Reliance

on Uncle Sam hits a record; 2010 income was 18.3%

entitlements

Dennis Cauchon, USA TODAY

Americans depended more on government assistance in 2010 than

at any other time in the nation's history, a USA TODAY analysis

of federal data finds. The trend shows few signs of easing,

even though the economic recovery is nearly 2 years old.

A record 18.3% of the nation's total personal income was a

payment from the government for Social Security, Medicare,

food stamps, unemployment benefits and other programs in

2010. Wages accounted for the lowest share of income —

51.0% — since the government began keeping track in 1929.

The income data show how fragile and government-dependent the

recovery is after a recession that officially ended in June

2009.

The wage decline has continued this year. Wages slipped to

another historic low of 50.5% of personal income in February.

Another government effort — the Social Security payroll

tax cut — has lifted income in 2011. The temporary tax

cut puts more money in workers' pockets and counts as an

income boost, even when wages stay the same.

From 1980 to 2000, government aid was roughly constant at

12.5%. The sharp increase since then — especially since

the start of 2008 — reflects several changes: the

expansion of health care and federal programs generally,

the aging population and lingering economic problems.

Total benefit payments are holding steady so far this year at

a $2.3 trillion annual rate. A drop in unemployment benefits

has been offset by rises in retirement and health care

programs.

Americans got an average of $7,427 in benefits each in 2010,

up from an inflation-adjusted $4,763 in 2000 and $3,686 in

1990. The federal government pays about 90% of the benefits.

"What's frightening is the Baby Boomers haven't really

started to retire," says University of Michigan economist

Donald Grimes of the 77 million people born from 1946 through

1964 whose oldest wave turns 65 this year. "That's when the

cost of Medicare will start to explode."

Accounting for 80% of safety-net spending in 2010: Social

Security, Medicare (health insurance for seniors), Medicaid

(health insurance for the poor) and unemployment insurance.

|

That's right, just under one fifth of all personal income (and

remember, that's 2.3 trillion dollars per year) now flows from

the hands of government into the pockets of your fellow citizens,

while only one half is actually earned by way of traditional work.

So, if you are on the receiving end of this 21st

century, automated bread line, then it certainly appears that Heinlein

was seriously mistaken and the free lunch is actually an all-you-can-eat

smorgasbord — so take your fill! And exactly how does this

money get administered? Why, through various federal domestic

assistance programs of course. And as I reported in my previous

piece, at the end of 2010, there were 2,094 of them, each making

sure that all deserving recipients were being hansomly serviced.

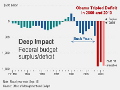

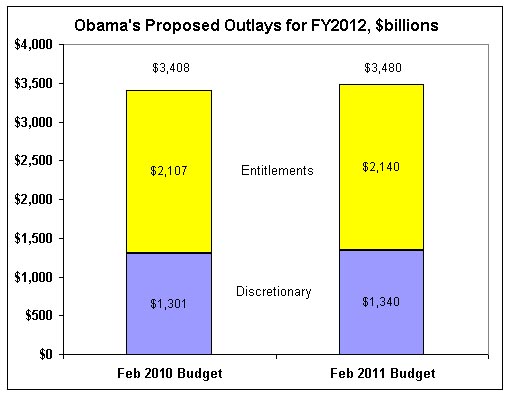

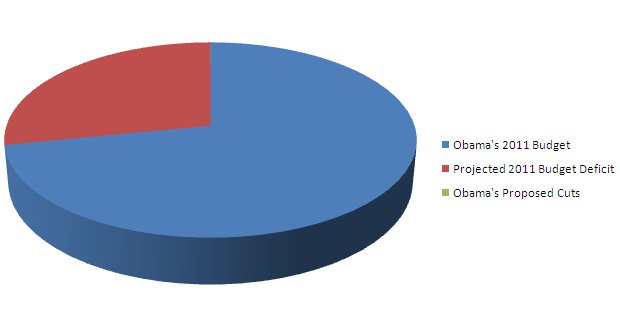

Now, since we are in the depths of a severe multi-year recession, with

a sluggish economy, an underemployment rate hovering around 20%,

rising inflation somewhere between 7-9%, a federal government running

an annual $1.65 trillion budget deficit, many state governments nearing

bankruptcy, and a robust discussion throughout the country about the

need for significant spending reductions, you might reasonably expect

that government programs would at least be frozen, awaiting development

of a plan designed to address these concerns. No such luck. Returning

to the the Catalog of Federal Domestic

Assistance website now reveals that there are currently

2,133 programs in existence, for an increase of thirty-nine

new programs just since the start of this year, including such

additions as:

- Pre-existing Condition Insurance Program

- Medicaid Emergency Psychiatric Demonstration

- Program for Early Detection of Certain Medical Conditions

Related to Environmental Health Hazards

- Community National Dissemination and Support for Community

Transformation Grants

- Biomass Crop Assistance Program

- Livestock Forage Disaster Program

- Emergency Assistance for Livestock, Honeybees, and Farm-Raised

Fish Program

- Durum Wheat Quality Program

- Aquaculture Grant Program

- Poultry Loss Contract Grant Assistance Program

- Distance Education Grants for Institutions of Higher Education

in Insular Areas

- ORA Grants to Meet Food, Nutrition and Health Needs of

Program Eligible Participants

- Export Guarantee Program

- Repowering Assistance

- Bioenergy Program for Advanced Biofuels

- Electronic Absentee Systems for Elections

- Community Economic Adjustment

- National Wetlands Inventory

- Endangered Species Conservation-Wolf Livestock Loss

Compensation and Prevention

- Coastal Impact Assistance Program

- National Heritage Area Federal Financial Assistance

- Mississippi National River and Recreation Area State

and Local Assistance

- New Bedford Whaling National Historic Park Cooperative

Management

- Overseas Schools Program

- EUR/ACE Humanitarian Assistance Program

- EUR/ACE National Endowment for Democracy Small Grants

- Weapons Removal and Abatement

- Export Control and Related Border Security

- Small Business Teaming Pilot Program

- State Trade and Export Promotion Pilot Grant Program

- International Compliance and Enforcement Projects

- Postal Model for Medical Countermeasures Delivery and

Distribution

It's no wonder we need to raise the $15 trillion debt limit ceiling,

with 2,133 programs like these, all in desperate need of funds.

You really cannot blame the citizens in our entitlement culture who

think that they can have their lunch and eat it too. After all, look

at the example that their legislators are setting as they coast along

on their own free-lunch wagon, creating whatever programs they desire,

and then printing paper dollars out of thin air to back them up, with

no foreseeable source of revenue in sight — and all the while

ignoring the looming debt, the unsustainable deficits, the unresponsive

economy, and the rising outcry of protest from the remaining minority

of citizens who do understand that there is indeed no free lunch and

that the coming catastrophe is going to ultimately be borne on the

backs of their productivity.

It's enough to make a grown person shrug.

Update:

- As of 06-06-13, the number of programs currently listed in the

Catalog of Federal Domestic

Assistance has now grown to 2,233. That's one hundred

additional entitlements that have been implemented without the

general public even being aware that this activity was occurring.

That's one hundred additional programs that are being funded

through taxation, inflation and debt, on the backs of an already

overburdened citizenry.

External links to reprints of this article:

|