11-14-2010

Permalink

"The Bernank"

|

Subject: Inflation is Not Your Friend!

Federal Reserve chairman Ben Bernanke thinks that we don't have enough

inflation in this country, so he is now engaged in printing up $600

billion crisp new dollars with which he will purchase government

securities such as treasury bills. Of course, the average person has

a glimmer of understanding that just printing money out of thin air

might not be such a good thing to do. (Don't we call that

counterfitting when others do it?) So the Fed tries to distract us

from those concerns by calling it Quantitative Easing, because

who actually understands exactly what that means? Well, let's

allow this short video explain it to us.

According to CNN

Money, in addition to the $600 billion in "new" cash, the Fed

also plans to "reinvest" up to an additional $300 billion from the

original $1.8 trillion in the 2008-09 first round of

Quantitative Easing. And we have already seen what a stupendous

failure that has been.

In an op-ed piece in the Washington Post,

Bernanke states:

|

The Federal Reserve's objectives — its dual mandate,

set by Congress — are to promote a high level of

employment and low, stable inflation.

|

What is so desirable about inflation, which is a decrease in the

purchasing power of money? Inflation means that producers are forced

to raise their prices, decreasing the size of their markets, and

consumers can obtain fewer goods and services with their earnings.

Why would anyone wish to promote or maintain inflation as a matter of

economic policy? The answer becomes clear once you determine exactly

who benefits from an ever inflating money supply.

As stated above, inflation is good for neither producers nor consumers.

But what about borrowers and lenders? Lenders provide cash for

today's purchases, with the promise to repay the principle plus

interest at some specified time in the future. With a stable

currency, it is easy to determine the rate of return on a given loan.

However, if the money supply is inflated during the course of the loan,

then the future dollars used to pay it back are worth less than those

loaned out in the present. Inflation works to the disadvantage

of the lender, but to the advantage of the borrower. Of course,

borrowers and lenders attempt to predict the level of inflation that

will occur over the duration of the loan and build this into the

interest calculations, but guessing too high means that the borrower

overpays for the loan, while underestimating the inflation means that

the lender does not achieve the anticipated rate of return on their

investment.

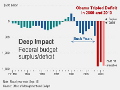

Now ask yourself, who is the biggest borrower of them all? The

obvious answer is the federal government, which as of today has

accumulated a national debt in excess of

$13.7 trillion,

and which continues to grow at an average of $4.14 billion each

day. The 2011 interest payment alone on this debt will be just under

$24.2

billion! If you could inflate the U.S. currency, just

imagine how much you would save by making this interest payment with

devalued dollars. Kick inflation up 3% and that makes your debt 3%

less valuable, which happens to be roughly a $411 trillion

savings without having to do anything except run some printing

presses. And if you can inflate 3% for a full year, than that 2011

interest payment can be effectively reduced by the equivalent value

of $726 million. Hey, not bad for a days work! In fact, why

stop at 3 percent? How about 4, 5 or more? You can never get too much

of a good thing!

Of course, there's no magic bullet here, because the government's debt

holders are sitting on the other side of this equation, and directly

lose a dollar for every one saved by Uncle Sam. And everyone else

sitting around with dollars (hey, that's you and me!) find that

their purchasing power is also reduced day by day. Inflation is really

just a hidden tax that the Fed and Treasury impose upon each of us to

cover their bills.

Now, if you listen to Bernanke, he will warn you of the dangers of

deflation:

|

Today, inflation is at 2%, below the Fed's target rate. While

low inflation is usually <sic> good thing, if

inflation gets too low, it can morph into deflation and

consequently economic stagnation

|

Here is what economist and market strategist Richard Salsman has to say

about this in his article, The

Deflation Myth:

|

The current anxiety over "deflation," that is, an increase in

money's purchasing power, causing a declining price level, is

ridiculous, for two reasons: (1) there's no actual deflation

to speak of (nor is it likely to occur in the coming few

years, given prevailing public policies), and (2) even if

some deflation were to take hold, it wouldn't necessarily be

bearish for equities, profits or economic growth.

Many economists presume, falsely, that deflation necessarily

coincides with (or causes) a contraction in economic output.

In fact, deflation by itself in no way curbs the motive to

produce, because it doesn't preclude the maintenance of

business profit margins. During the Industrial Revolution,

deflation was common. It was also a bullish phenomenon in the

second half of the 19th century, the period of the fastest

economic growth in human history.

The only genuine danger from deflation is that faced by

over-indebted, would-be deadbeats.

|

Possibly, Bernanke's real concern with deflation is that should it

occur, the U.S. government would find itself sitting on the other

side of the table, having to repay their immense debt with dollars of

increasing rather than decreasing value. And that is something that

should truly worry him! Maybe the Fed and Treasury are really nothing

more than those "would-be deadbeats" that Salsman warns of,

trying to insure that it is us and not them that take it in the shorts!

What do you think is the most likely explanation for a government that

has set inflation as its self-acknowledge mandate?

|