05-14-2011

Permalink

Growth Of The

National Debt

|

Subject: Balancing The Federal Budget: A Simple Proposal

Take a look at the following chart:

See any possible problems there? From 1940 and for thirty years

thereafter, although the the national debt was increasing, it did

so at a fairly slow rate. However, by the 1970s the rate of increase

starts to accelerate as indicated by the steepening curve, until the

rate begins to go asymptotic around 2007, indicating that the the

factors controlling the debt have gotten completely out of control.

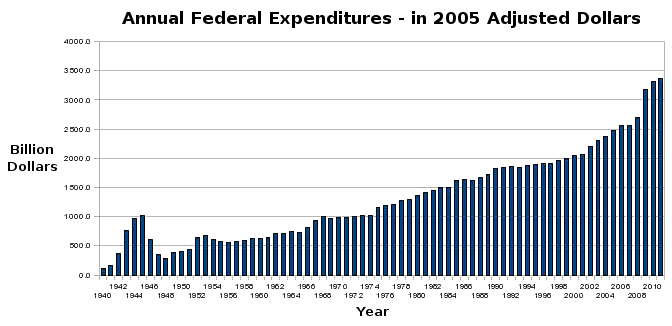

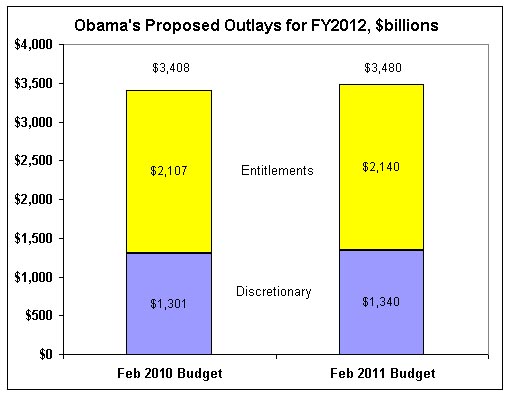

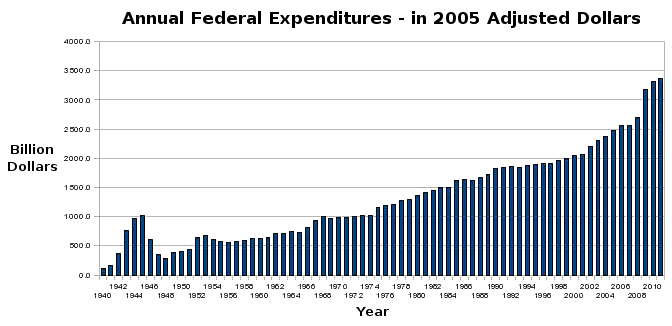

Now, examing the annual level of federal spending in constant,

inflation-adjusted dollars.

See any possible problems there? From 1940 and for thirty years

thereafter, although the the national debt was increasing, it did

so at a fairly slow rate. However, by the 1970s the rate of increase

starts to accelerate as indicated by the steepening curve, until the

rate begins to go asymptotic around 2007, indicating that the the

factors controlling the debt have gotten completely out of control.

Now, examing the annual level of federal spending in constant,

inflation-adjusted dollars.

Here we see a fairly constant year-after-year increase in federal

spending, indicating the steady growth in the overall size of

government. Let's break this down by decade.

Here we see a fairly constant year-after-year increase in federal

spending, indicating the steady growth in the overall size of

government. Let's break this down by decade.

|

Decade

|

Average Annual Spending

in Constant 2005 Dollars

(Billions)

|

Spending Increase

From Previous Decade

(Percent)

|

Ratio of 2011

Govmt. Spending

to Decade Average

|

|

1940s

|

$502.4

|

–

|

7.6x

|

|

1950s

|

$569.7

|

13.4%

|

6.7x

|

|

1960s

|

$788.4

|

38.4%

|

4.8x

|

|

1970s

|

$1,115.2

|

41.5%

|

3.4x

|

|

1980s

|

$1,549.9

|

40.0%

|

2.5x

|

|

1990s

|

$1,893.1

|

22.1%

|

2.0x

|

|

2000s*

|

$2,597.6

|

37.2%

|

1.5x

|

* 12 year average: 2000-2011

Even if we assume that the 2011 expenditures is an anomaly and consider

decade averages only, these figures show that government size in the

2000s is over five times larger than it was during the 1940s.

And if we average the expenditures for the thirty year period from

1940-1969, our current federal government has still increased more than

four times over that historical level.

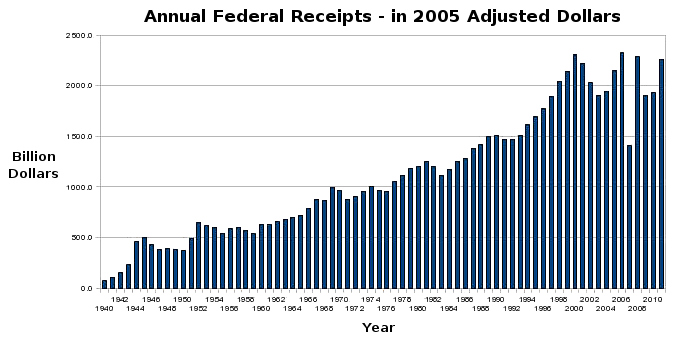

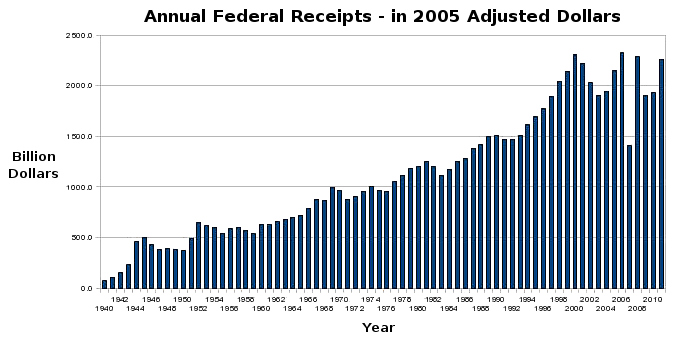

Now, let's take a look at the revenue side of the picture.

As with expenditures, we observe a steady increase in revenue, every

penny of which comes from American citizens, either directly or

indirectly. Breaking this data down by decade reveals the following:

As with expenditures, we observe a steady increase in revenue, every

penny of which comes from American citizens, either directly or

indirectly. Breaking this data down by decade reveals the following:

|

Decade

|

Average Annual Revenues

in Constant 2005 Dollars

(Billions)

|

Revenue Increase

From Previous Decade

(Percent)

|

Ratio of 2011

Govmt. Revenue

to Decade Average

|

|

1940s

|

$313.2

|

–

|

6.9x

|

|

1950s

|

$556.5

|

77.7%

|

3.9x

|

|

1960s

|

$754.2

|

35.5%

|

2.9x

|

|

1970s

|

$999.3

|

32.5%

|

2.2x

|

|

1980s

|

$1,275.9

|

27.7%

|

1.7x

|

|

1990s

|

$1,711.3

|

34.1%

|

1.3x

|

|

2000s*

|

$2,139.4

|

25.0%

|

1.0x

|

* 12 year average: 2000-2011

Note the steady and very substantial decade-after-decade increase

in the amount of wealth extracted from productive individuals and

businesses. Examining just the period from 2000-2011, the total

revenue (in 2005 dollars) was $25.7 trillion. If government spending

had been held to the 1980s average of $1.55 trillion/year for a

total expenditure of $18.6 trillion over the same 12 year period,

then there would have been a net surplus of $7.1 trillion,

which would have allowed for the complete elimination of the $5.6

trillion debt that existed in 2000, with a $1.5 trillion cushion

remaining.

Stop and think about that. With a steadily increasing revenue stream

that not only could meet all existing expenses, but would have allowed

the entire national debt to be retired in just over a decade, what

happened? And how instead, did the debt almost triple in such a short

period of time?

This chart tells the story:

The national debt continues to rise, because, no matter how much

revenue is at their disposal, and no matter how significantly it

increases, the Congress and the President work diligently to spend

every available nickel, and then go into debt in order to spend

even more — lots more! As this chart shows, the government

has run a deficit 28 out of the last 32 years, or 88% of the

time.

And a review of the historical

data reveals that since 1940, there have been deficits 60 out of

the past 72 years!

During that 72 year period, while both the Republican and the

Democratic parties have held the presidency in equal measure (36 years

each), together, they have managed to balance the budget less than 17%

of the time (five times under Republicans and seven times under

Democrats). And of those 12 budget surpluses, only six were used to

slightly reduce the debt, the last time being 42 years ago in 1969.

During the past seven decades, the current $14.3 trillion debt

has been ratcheted back by just $25.5 billion, or less than 0.2% of

the current total!

For 2011, our $3.82

trillion budget

includes an estimated $1.65

trillion deficit, which pushes total federal debt well

beyond the current $14.3

trillion spending cap. At currently projected spending levels,

the debt is estimated to be rapidly approaching

$20 trillion

by 2015.

In 2010 alone, the United States paid $414 billion simply to

finance the debt burden. And since 2000, interest payments exceed

$4.4

trillion. That is money that has been removed from productive

use by individuals and businesses in the U.S. economy and sent

primarily to foreign

creditors, including: China, Japan, UK, Brazil, Taiwan, Russia, and

so on.

While a number of intellectuals in the political and financial spheres

have, for many years, been sounding alarm bells about the pending

disaster being created by a ballooning debt, rising interest payments,

and the unfunded

liabilities resulting from Social Security, Medicare and Medicaid,

it wasn't until early in 2009 that a large segment of the general

public awoke to the imminent economic danger presented by unsustainable

government expansion, coupled with the the rise of a totalitarian

political class, leveraging America's cultural shift away from

self-reliance and personal responsibility and towards a helpless

entitlement mentality. The rise of the Tea Party movement was the

political response to these new realizations.

In the 2010 elections, the clear message sent was that past political

behavior was no longer going to be tolerated by the public. The budget

was to be balanced, the debt paid down, earmarks eliminated, taxes

reduced, federal spending slashed, and the size and regulatory burden

of government was to be significantly decreased. In general, Democrats

ignored this outcry and were resoundingly defeated by Republicans who

at least paid lip service to these demands. However, after returning

to D.C. following the elections, the overall performance by the new

congressional members has been extremely disappointing. Republicans

who once spoke of slashing spending, balancing the budget, repealing

Obamacare, significantly reducing the size of government, and

returning to a rule of law in strictly proscribed areas, as dictated

by the Constitution, have failed to even take a firm stand on these

issues, let alone deliver meaningful results on their promises.

For example, prior to the 2011 budget negotiations, Republicans promised

a rather anemic $100 billion (2.6%) reduction against Obama's huge

$3.82 trillion budget and $1.65 trillion deficit. However, by the

time the budget was finalized in April, they had capitulated to a

mere $38.5 billion (1%) reduction, which then turned out to actually

be a true savings of only $352

million (0.01%), leaving the Democrats laughing all the way to

the printing presses.

The national debt continues to rise, because, no matter how much

revenue is at their disposal, and no matter how significantly it

increases, the Congress and the President work diligently to spend

every available nickel, and then go into debt in order to spend

even more — lots more! As this chart shows, the government

has run a deficit 28 out of the last 32 years, or 88% of the

time.

And a review of the historical

data reveals that since 1940, there have been deficits 60 out of

the past 72 years!

During that 72 year period, while both the Republican and the

Democratic parties have held the presidency in equal measure (36 years

each), together, they have managed to balance the budget less than 17%

of the time (five times under Republicans and seven times under

Democrats). And of those 12 budget surpluses, only six were used to

slightly reduce the debt, the last time being 42 years ago in 1969.

During the past seven decades, the current $14.3 trillion debt

has been ratcheted back by just $25.5 billion, or less than 0.2% of

the current total!

For 2011, our $3.82

trillion budget

includes an estimated $1.65

trillion deficit, which pushes total federal debt well

beyond the current $14.3

trillion spending cap. At currently projected spending levels,

the debt is estimated to be rapidly approaching

$20 trillion

by 2015.

In 2010 alone, the United States paid $414 billion simply to

finance the debt burden. And since 2000, interest payments exceed

$4.4

trillion. That is money that has been removed from productive

use by individuals and businesses in the U.S. economy and sent

primarily to foreign

creditors, including: China, Japan, UK, Brazil, Taiwan, Russia, and

so on.

While a number of intellectuals in the political and financial spheres

have, for many years, been sounding alarm bells about the pending

disaster being created by a ballooning debt, rising interest payments,

and the unfunded

liabilities resulting from Social Security, Medicare and Medicaid,

it wasn't until early in 2009 that a large segment of the general

public awoke to the imminent economic danger presented by unsustainable

government expansion, coupled with the the rise of a totalitarian

political class, leveraging America's cultural shift away from

self-reliance and personal responsibility and towards a helpless

entitlement mentality. The rise of the Tea Party movement was the

political response to these new realizations.

In the 2010 elections, the clear message sent was that past political

behavior was no longer going to be tolerated by the public. The budget

was to be balanced, the debt paid down, earmarks eliminated, taxes

reduced, federal spending slashed, and the size and regulatory burden

of government was to be significantly decreased. In general, Democrats

ignored this outcry and were resoundingly defeated by Republicans who

at least paid lip service to these demands. However, after returning

to D.C. following the elections, the overall performance by the new

congressional members has been extremely disappointing. Republicans

who once spoke of slashing spending, balancing the budget, repealing

Obamacare, significantly reducing the size of government, and

returning to a rule of law in strictly proscribed areas, as dictated

by the Constitution, have failed to even take a firm stand on these

issues, let alone deliver meaningful results on their promises.

For example, prior to the 2011 budget negotiations, Republicans promised

a rather anemic $100 billion (2.6%) reduction against Obama's huge

$3.82 trillion budget and $1.65 trillion deficit. However, by the

time the budget was finalized in April, they had capitulated to a

mere $38.5 billion (1%) reduction, which then turned out to actually

be a true savings of only $352

million (0.01%), leaving the Democrats laughing all the way to

the printing presses.

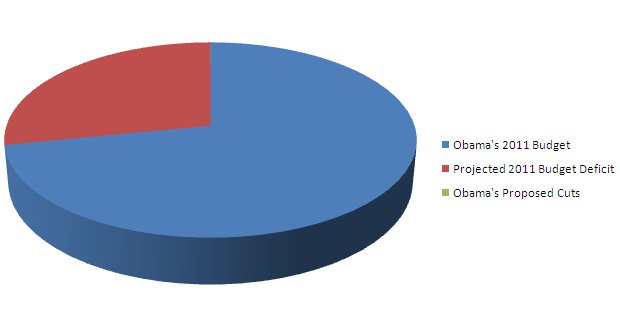

Or consider Paul Ryan's much touted "Path to Prosperity", which

the Republicans offer as their alternative for addressing entitlement

liabilities while cutting spending by $6.2 trillion over the next 10

years. Well that sounds pretty good until you look a bit closer. Did

you think that current spending levels were going to be reduced by

$6.2 trillion? Well fuggedaboutit. This is just the Republicans using

the standard political trick of misdirection, as the following chart

reveals:

Or consider Paul Ryan's much touted "Path to Prosperity", which

the Republicans offer as their alternative for addressing entitlement

liabilities while cutting spending by $6.2 trillion over the next 10

years. Well that sounds pretty good until you look a bit closer. Did

you think that current spending levels were going to be reduced by

$6.2 trillion? Well fuggedaboutit. This is just the Republicans using

the standard political trick of misdirection, as the following chart

reveals:

Ryan's plan has no intention of balancing the budget in the foreseeable

future. He has government spending increasing year by year, just not

quite as fast as Obama's own proposal. His $6.2 trillion is not a

real savings, but just some imaginary gap between his fantasy

projection for the future and that of the current administration, both

of which are unrealistic because, as with almost every past budget,

they significantly overestimate future revenue while underestimating

future outlays, giving us an 88% change of continuing deficits and an

ever growing debt.

It is all a form of political theater and wish fulfillment that runs

through every thread of government, best illustrated by the recently

released Changes

in CBO's Baseline Projections Since January 2001, which reports:

Ryan's plan has no intention of balancing the budget in the foreseeable

future. He has government spending increasing year by year, just not

quite as fast as Obama's own proposal. His $6.2 trillion is not a

real savings, but just some imaginary gap between his fantasy

projection for the future and that of the current administration, both

of which are unrealistic because, as with almost every past budget,

they significantly overestimate future revenue while underestimating

future outlays, giving us an 88% change of continuing deficits and an

ever growing debt.

It is all a form of political theater and wish fulfillment that runs

through every thread of government, best illustrated by the recently

released Changes

in CBO's Baseline Projections Since January 2001, which reports:

|

Each year, the Congressional Budget Office (CBO) issues

baseline projections of federal spending and revenues for the

following 10 years. Those projections are not intended as a

forecast of future outcomes; rather, they are estimates of

spending and revenues under the laws that are in effect at

that time and are designed to provide a benchmark against which

to measure future policy changes.

In January 2001, CBO's baseline projections showed a cumulative

surplus of $5.6 trillion for the 2002-2011 period. The actual

results have differed from those projections because of

subsequent policy changes, economic developments that differed

from CBO's forecast, and other factors. As a result, the

federal government actually ran deficits from 2002 through 2010

and will incur a deficit in 2011 as well. The cumulative

deficit over the 10-year period will amount to $6.2 trillion,

CBO estimates—a swing of $11.8 trillion from the January

2001 projections.

|

How many times do you think the CBO has been off $11.8 trillion

dollars in the other direction?

My simple (and unrealistic) proposal:

Having observer the new Congress unsuccessfully tackle issues such

as the 2011 budget, it seems clear that, as things stand, nothing of

real substance can be expected to be accomplished. So long as Congress

retains the ability to both set the level of spending as well as

determine where that spending is to be allocated, there remains little

hope that they will ever exercise any real fiscal restraint and make

the difficult choices that are required. And we taxpayers are the ones

left on the hook for the tab they continue to accumulate.

The unrealistic part of my proposal — something that would

require a change to the Constitution — is that the ability

to set the overall annual spending level must be removed from the

hands of government completely. In the long run, there are a number

of ways that these levels could be determined, but I believe that

the best would be to simply establish some very reasonable but fixed

dollar amount that would be the sum total available for all normal

government operations, with a provision for automatic adjustment

to account for inflation/deflation. This would then be coupled with

a balanced budget amendment that would require that the government

maintain its spending strictly within this limit. Emergency

situations such as declared wars, would be precisely defined, and

funding for these activities would be handled by other means, but

the overall size and nominal cost of government functions would be

strictly proscribed and fully understood by all citizens.

Given a known annual budget, it would then be up to Congress to

determine how to allocate these dollars. They could fund government

payroll, pensions and insurance. They would be responsible for

facility rent, new construction and maintenance. They would apportion

funds between agencies such as the CIA, FBI, the Armed Services and

others. They could fund entitlement programs, or promote initiatives

like cash-for-clunkers or home window replacement for energy

conservation. They could send aid to foreign countries, support the

UN or invest in promising new technologies. Money could be spent on

pure research or used to build and launch rockets. Some funds might

go to help the poor obtain health insurance or purchase prescription

drugs, while others could be used to build bridges to nowhere or

monuments to past presidents or fight the "war" on drugs. The sky's

the limit. The only condition would be that should they wish to

allocate some funds to one area, for example, to set up a presidential

cell phone emergency alert system, then these dollars would have to

come from or at the expense of something else. Citizens would elect

representatives that promised to promote things of agreed importance,

and then it would be up to those representatives to work with other

congressional member to devise the best allocation strategy —

just an families and businesses routinely do every day as a matter of

course. One huge consequence of this approach is that it would very

quickly be determined what the real priorities were for all of the

possible expenditures. It would soon become evident how entitlements

for the needy weighed in relation to immigration reform, illegal drug

use, energy policy, and so on.

To implement this plan would also require addressing the problem of

getting from here to there. Right now our deficit is $1.65 trillion

in relation to a budget of $3.82 trillion, making the deficit a

whopping 43% of the total! My proposal would be to immediately

start cutting the existing budget across the board by 10%, or $382

billion for each of the next five years: 2012-2016. By declaring that

these cuts apply equally to all areas of government — from the

military to entitlement programs to salaries to regulatory agencies

— it eliminates the grid lock we currently see where each party

jockeys to fund their pet programs while defunding those of the

opposition. Since they are unable to do it themselves, we will make

all of the hard decisions for them.

This would reduce the 2016 budget down to $1.9 trillion, or about the

same level of spending as in 1989 (in equivalent dollars), while fully

eliminating the deficit and yielding a small surplus. From 2017

onward, continue to reduce the budget by 5% each year, applying all

surplus to retiring the outstanding debt. Maintain this process until

the desired spending target level is reached and then freeze it. Once

the deficit is eliminated, begin reducing or restructuring taxes to

produce an ongoing revenue with a slight surplus, which is banked

strictly for use against future revenue short falls and nothing else.

As the budget reductions went into effect, it would be left to Congress

to start reallocating the remaining funds to support areas of greater

importance while defunding those of less utility. This would require

that every aspect of current government operation be brought up for

discussion and a detailed review, a process which, as previously

discussed, does wonders to focus the mind on one's priorities.

If something along these lines is not enacted, and if we simply

continue along our present course, spending our way into oblivion while

maintaining a regulatory environment that is crippling the economy with

uncertainty, then it will not be too long before the U.S. reached

it's own tipping point, and then, like Greece, Portugal, Ireland and

others, we will no longer possess the ability to recover on our own.

And no one is waiting in the wings to bail us out.

A few brave Tea Party-backed candidates have made it to Washington

with the resolve to fight the system and work to effect real change.

However, there are as yet too few of them to wield real clout. Over

the course of the next few election cycles, I believe that there is an

opportunity to replace many more of these liberal Democrats and RINOs

(Republicans In Name Only) with true fiscal conservatives who could

work together to accomplish the goals that have been promised, but

which are being evaded by the current Congress. Let us hope that they

arrive in time, and when they do, that they will be prepared to take

bold action, similar to what I outline here, allowing the necessary

corrections to occur as quickly as possible, so that our economy can

begin to expand and thrive, once again, assuming its rightful

leadership position in the world.

|